Would you like Realize Impact’s help in operating a philanthropic impact investment partnership? This page answers the most frequently asked questions on that process. For answers on how to invest in an existing partnership, see our investment FAQ.

1. What responsibilities would my organization have?

You find the donor-investors. You find the investment opportunities. In short, you do the “front end” work of operating a partnership while Realize Impact operates the back end.

2. What does Realize Impact do?

We manage the money and the investments. As a 501(c)(3) public charity, we accept donations, and as explained in the investment FAQ, those investments have an attached recommendation, in this case for one of our partnerships.

Our partner then periodically recommends where to invest the pooled capital. The partner and Realize Impact jointly diligence the investment opportunity, ensuring it is both prudent and impactful.

Realize Impact then reviews, negotiates (if needed), and signs the investment documents. Realize Impact is the investor of record for investments made from the investment partnerships it manages.

Realize Impact later “harvests” the results of the investments, returning 99% of the results either back to the donor’s DAFs (or back to the foundations for institutions), or recycled back into the investment partnership for more investments.

All these activities are together called the “back end” of investment partnership management.

3. Are each of these partnerships their own limited partnerships, LLC, etc?

No, the investment partnerships are all projects of Realize Impact, a Washington State not-for-profit 501(c)(3) public charity.

No LPs or LLCs are required, as all the capital in these investment partnerships are provided as donations to Realize Impact. There are thus legally no limited partners nor general partners, just a charity that is making impact investments and donating 99% of the proceeds to other 501(c)(3) organizations.

4. Who is the investor of record?

Realize Impact is the investor of record for the investments made from these investment partnerships.

5. Can a nonprofit be an accredited investor?

Yes, Realize Impact is an accredited investor.

An entity is considered an accredited investor if it is an organization with assets exceeding $5 million, not formed with the sole purpose of purchasing specific securities.

6. Why does Realize Impact operate investment partnerships?

There is a lot of overhead in managing small partnerships, especially if each pool of capital is its own limited partnership or LLC. Realize Impact doesn’t need to use those complex structures, and passes on that savings to organizations who otherwise would not have the resources.

Plus, Realize Impact has deep experience reviewing and making impact investments globally. We are able to share that experience with organizations that don’t have that experience in-house, making it easy for more organizations to make impact investments in partnership with us.

Lastly, because investment capital for impactful companies is limited, every new philanthropic impact investment partnership helps.

7. What is Realize Impact’s experience?

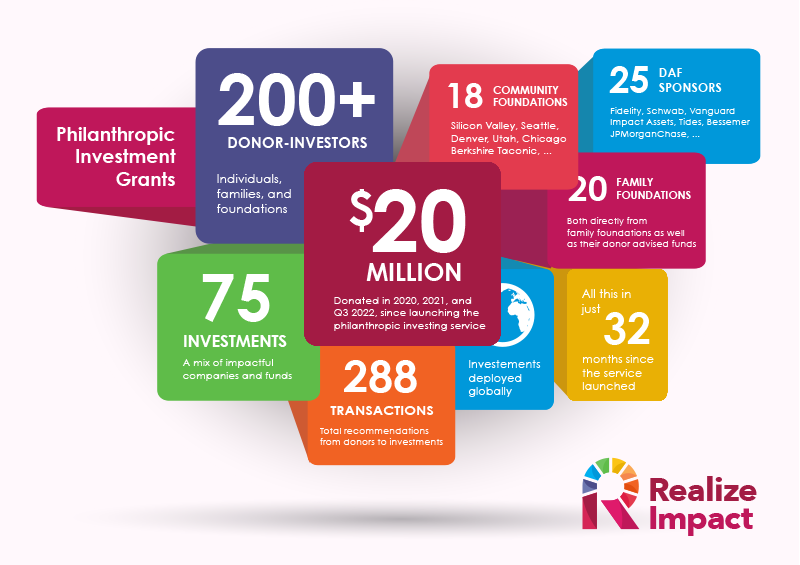

Our Philanthropic Investing (PHIG) service launched in February 2020. By the end of 2022, less than three years later, with $0 spent on marketing, over $20 million had been recommended and invested, arriving from over 200 donor-investors, invested into over 75 investees.

8. Is Realize Impact a DAF?

No. Realize Impact does not accept donations that do not also include a recommended investment. The only capital that doesn’t quickly get invested is capital recommended for one of the investment partnerships we manage. But that capital does not sit around for years, like it can in a DAF, just week or months while the partner does the research for the next recommended investment.

9. Does Realize Impact invest outside the U.S.?

Yes. Realize Impact has made investments both inside the U.S. and outside of the U.S.

10. How do we pick the investments from the investment partnerships?

We don’t pick, our partners make recommendations. We help with the diligence of those recommendations.

11. What happens if the investment fails?

The typical use of donor-advised funds is a grant to a 501(c)(3) public charity. When you make those grants, you are guaranteed that 0% of your capital will be returned. In investing we call this a -100% return.

Worst case, your recommended investment has no return, the same as a grant. Hopefully in those cases some impact has taken place, similar to a grant to a nonprofit.

You already received a tax deduction back when you donated into your DAF, so there is no additional write-off if the investment fails.

12. What happens if the investment is a success?

99% of the results of the investment (principal, interest, capital gains, dividends, etc.) is donated back to the DAF or family foundation where it came from, or to some other 501(c)(3) recommended by the donor. Or, if requested, 99% of the results are recycled into the investment partnership to be invested again.