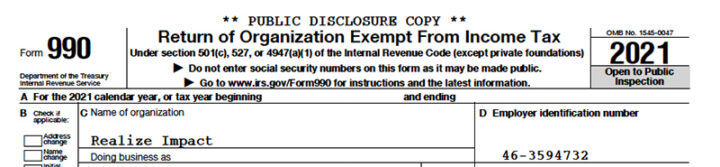

Realize Impact is a 501(c)(3) public charity. As such, we file a 990 tax form annually, and that form is publicly available from the IRS and other databases, or click below to download it directly.

Download the 990

Impact investing is complicated. How do you balance impact and investment returns, local vs. global impact, 17 Sustainable Development Goals, debt, equity, and revenue-sharing? All while deciding whether to invest from your savings, your family office, or your foundation or donor-advised fund?

Realize Impact is here to help make impact investing easy. We know how to make impact investments, create impact, and then harvest the investment returns. What we are looking for are your recommendations for impactful investments, and the capital to make those investments.

All it takes are three simple steps:

Make a grant from your donor-advised fund, foundation, or your own funds, recommending an impact investment

Realize Impact does the diligence, reviews the terms, and makes the debt, equity or revenue-based investment.

We donate 99% of the investment returns to your recommended DAF, foundation or other 501(c)(3) nonprofit.

Or in other words, you do the easy parts and we’ll do the complicated parts. When you find a good impact investment, tell us about it. We’ll spread the word so that others can join in too, helping catalyze your capital into yet more impact. Later, if the investment turns out to be fruitful, we’ll put almost all of those returns into a donor-advised fund, foundation, or charity, so it can do even more good for the world,–or give us a new suggestion and we’ll invest that capital again and again and again.

We do this for one low flat fee:

$500 for investments

of $10,000 or more.

* There is no fee for investments under $10,000, but the investment returns will not be re-donated.

See the details on the Philanthropic Investment Grant or fill out our PHIG Recommendation form to get started.

See the FAQ to answer the most frequently asked questions about this service.

And yes, the service is as simple as it sounds, by design.

RevHubOC is building a like-minded community of social investors and entrepreneurs in Orange County, California (the south end of the Los Angeles Metropolitan Area) in order to accelerate scalable and sustainable solutions to the world’s greatest challenges. Four donors from the Orange County Community Foundation recommended that Realize Impact invest in this important piece of local...

A donor advised fund is a great way to organize your philanthropy. But did you know that it can also be used to make impact investments? Not just the small selection your community foundation or other DAF sponsor suggests, but (just about) ANY impact investment, whether an impact fund or a mission-driven for-profit company? This is vastly different from what most donor advised funds tell their...

ImpactAlpha, December 6 – It’s been a difficult year for many run-of-the-mill tech funds seeking fresh powder. Impact funds, from climate tech to gender-lens vehicles, are leaning into more resilient (and urgent) trends. Many in turn are surpassing their fundraising targets.This month’s Liist, in partnership with Realize Impact, features a few funds that are nearing their final close. California...

The terms “impact investing” and “ESG” (Environmental, Social, and Governance) are not synonyms. The investments Realize Impact does through its philanthropic investment grants (PHIGs) and the investment touted on The Liist are impact investments, with and without regard to ESG. Stanford University’s SSIR explains the history of the two terms and tries to define...

The mainstream media defines and talks about impact investing in terms of “ESG“, i.e. Environmental, Social, and Governance. Those measures help ensure a company is well managed, but those measures alone don’t explain whether a company is impactful or not. Nor a fund. “Impact” measures whether the investee makes a positive contribution to solving real problems. And...

Realize Impact invested $60,000 into Steward Technologies, a company promoting environmental and economic stewardship through regenerative agriculture. They do this by providing flexible loans to human-scale farms, ranches, fisheries, and food producers looking to propel their operations forward.

Investments are always open into their fund:

Realize Impact invested $100,000 into Starlight Cardiovascular 15 months ago. Starlight Cardiovascular is developing a portfolio of devices to treat babies born with congenital heart defects. From their website:The company is developing much needed tools and devices to treat pediatric congenital heart defects (CHDs). Approximately 1.3 million babies are born each year with a CHD. Most of the...

UbiQD is an advanced materials company powering product innovations in agriculture, clean energy, and security. Our quantum dots enable industry leaders to harness the power of light and our first product, UbiGro®, is a layer of light that helps plants get more from the sun. At UbiQD, we know that great technologies depend on great materials. Our patented quantum dots hold the key to unlocking...

R.I.S.E. Artisan Fund has invested in Fuchsia Shoes, a sustainable fashion brand manufacturing handcrafted shoes based on the traditional Pakistani khussas. We deliver high quality, ethically made and environmentally responsible shoes to the American consumer directly. Our customers’ purchase of Fuchsia Shoes genuinely benefits the artisans who make them.” R.I.S.E. Artisan Fund, an initiative of...